If you’re going solar for the first time or adding to your residential solar system, a big part of making your decision make financial sense is claiming the financial incentives you qualify for. The Residential Clean Energy Credit, commonly known as the solar tax credit, is a way to save a lot of money in federal taxes. You must follow the IRS’s rules though, and that means completing and filing a Form 5695.

In 2024, the Residential Clean Energy Credit isn’t just for home solar panels. It can be used with multiple clean energy efficiency additions and improvements for residential properties. So, for solar or another type of clean energy investment, if you’re wondering how to fill out Form 5695 and make sure you get the solar tax credit you’re owed, this article will help. We’ll give you step-by-step instructions.

See how much you can save by going solar with Palmetto

What is IRS Form 5695?

Form 5695 is the IRS document you submit to get a credit on your tax return for installing solar panels, or adding to or upgrading a solar system, on your home. We commonly think of Tax Form 5695 as the Residential Clean Energy Credit Form.

You can request a copy of Form 5695 from the Internal Revenue Service (IRS) Website, and also review its Form 5695 instructions.

The document itself uses the term “Residential Energy Credits” which is the specific term used by the IRS to calculate non-refundable credit for a residential energy-efficient property. However, only qualified residential energy-efficient improvements in the United States are eligible for the credits. This includes new installations and renovations such as residential solar panel systems, solar energy storage, fuel cells, solar water heaters, geothermal heat pumps, and small wind turbines.

In 2024, there is now a second section on Form 5695 for homeowners to earn an additional $1,200 in tax credits for home energy audits and other qualified energy-efficiency updates such as new windows, doors, insulation, and more.

What is the Solar Energy Tax Credit?

The solar tax credit is a federal tax credit for solar systems you can claim on your income taxes, and reduces your federal tax liability. The tax credit is calculated based on a percentage (30% in the year 2024) of the total cost of your solar energy system.

This federal residential solar energy credit makes solar energy more affordable by giving a dollar-for-dollar tax reduction. Your solar energy system must have started service during the current tax year to qualify for the credit and you need to file IRS Form 5695.

Tax credits vs. deductions and discounts

Since these tax credits are not deductions, they generally reduce the amount of tax the claimant owes, which can create a tax refund. The tax credit is also not a “discount” as taxpayers pay the cost of the improvements when they are done, and then claim the credit from the IRS when filing their tax returns.

Taxpayers can claim these credits on IRS Form 5695 regardless of whether or not they itemize deductions on Schedule A.

Eligibility for the Residential Clean Energy Credit in 2024

For solar projects on new and existing homes in the US, the Residential Clean Energy Credit can be claimed today if the following requirements are met.

- You live in the United States and have an outstanding federal income tax liability. Properties outside of the US may not claim the RCEC.

- You purchase a new (not used) qualifying energy system. This includes solar panels, solar water heaters, wind turbines, geothermal heat pumps, fuel cells, and battery storage technology. Leased energy systems do not qualify.

- You obtain all the necessary building permits and install the energy system on a property in which you own and reside. You cannot claim the RCEC on a full-time rental property.

To learn more, read Everything You Need To Know About The Solar Tax Credit.

State-specific solar incentives and tax credits

There may be some additional state income tax credits available for homeowners in the United States. You would claim these when you file your state taxes and not when you file Form 5695 for your federal taxes. In 2024, there are only a handful of states that offer income tax credits for solar energy systems, including:

- A Massachusetts solar state tax credit equal to 15% of the system cost up to $1,000.

- A similar tax credit for solar energy systems in Arizona, with deductions of up to $1,000 on state income taxes.

- Credits of up to 25% of adoption costs for solar panels in South Carolina, which can be claimed over the course of 10 years on state income taxes.

Note: State solar incentive programs are constantly evolving and may become available or unavailable anywhere, at any time. While you will not use Form 5695 for state-level clean energy incentives, a Palmetto expert can help you identify and claim all of the credits and rebates for which you may be eligible.

To learn more, read State Solar Tax Credits: Forms and Instructions.

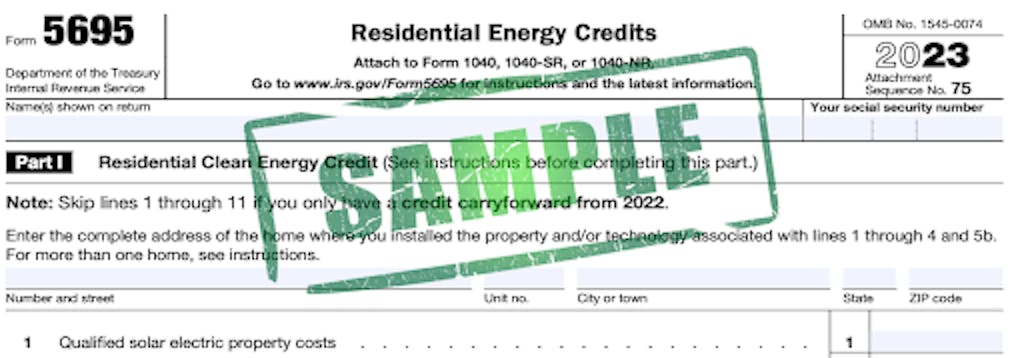

Edited image from the Internal Revenue Service (February 2024)

How to Fill Out IRS Form 5695 for the Solar Tax Credit

The Residential Clean Energy Credit is a big incentive for people adopting any number of energy-efficient systems on their property. Claiming the solar energy tax credit can offset some of the expenses of making energy-efficient improvements to your home.

However, not all taxpayers and improvements qualify for the credits. Your improvements must meet specific energy efficiency requirements, and first-time homebuyers must adhere to particular rules to qualify.

Review the IRS Form 5695 Instructions to confirm your eligibility. You can then complete the form and include it on Form 1040.

Step 1 - Calculate the total cost of your solar power system

The total system costs of the solar power system for your home is the gross (total) amount you spent on it from your solar company, minus any other cash rebates you received, including state tax credit, incentives, and rebates. Add this number to line 1.

When talking to potential solar installers, it is important to verify the exact details of your quote and know your total buying costs with and without the solar credit. Total system price includes every necessary project line item, including equipment, labor, wiring, permitting, inverter, and other associated costs.

See how much you can save by going solar with Palmetto

Step 2 - Add additional energy-efficient improvements

Fill in the total cost of any other qualifying energy upgrades you might have made on lines 2 through 5. These additional home improvements include home solar water heating, small wind energy generators, geothermal heat pump property costs, and battery storage with a capacity of “at least 3 kilowatt-hours.” Add these up for line 6a.

Note: Other Energy Efficiency upgrades (such as insulation, skylights, and other home improvements) may be added to Form 5895 Part II.

Step 3 - Calculate the tax credit value

Calculate the federal solar tax credit you qualify for by multiplying the number from line 6a by 30%. Place the answer on line 6b. If you are not receiving a tax credit for fuel cells, you can skip lines 7 through 11.

Step 4 - Enter your tax credit value

If this is your first time filing Form 5695 for the solar tax credit, then you can enter the value from line 6b into line 13 – that is, unless you also purchased fuel cells or have any tax credits to carry forward from the previous year. In these cases, line 13 will be the total of line 6b and 11 or 12, depending.

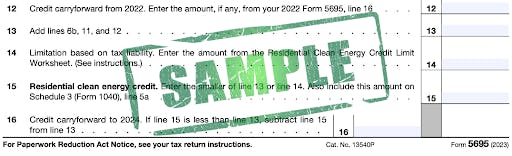

Step 5 - Calculate your tax liability

Calculate if you have sufficient tax liability from your taxable income to get the full 30% tax credit available in one year. For the best results, income tax liability calculation should be done with the help of a trained professional.

Step 6 - Calculate the maximum tax credit you can claim

Calculate the maximum tax credit you can claim by turning to page 4 and completing the instructions for that worksheet. You will need to include any information about any other tax credits for which you qualify, including buying an electric vehicle, being a first-time homeowner, or interest on your mortgage.

Step 7 - Enter your maximum tax credit

Enter the result of the Residential Clean Energy Credit worksheet (the limit of the tax credits you can claim) to line 14. Compare the values of lines 13 and 14 and put the smaller of the two on line 15 of the form.

Edited image from the Internal Revenue Service (February 2024)

Step 8 - Calculate any carry-over credit

Compare your tax liability from step 5 with your tax credits. If your tax liability is smaller, calculate the amount you can claim on next year's taxes by subtracting the value on line 15 from line 13. Enter the result on line 16.

Step 9 - Enter your credit on Form 1040

The value you filled on line 15 is the amount the IRS will credit on your taxes this year. Enter this number on line 5 of Schedule 3 on Form 1040. If you make additional energy-efficient home improvements in the fiscal year, you may qualify for other tax credits. If so, you will need to complete the second page of Form 5695.

Timeline, Tips and Troubleshooting

Form 5695 must be completed for the tax year in which your solar panel system was installed.

For example, let's say that you purchase solar panels in February 2024, and they are installed during the first week of May. In this scenario, you should fill out the form whenever you are filing your 2024 taxes, which—for most people—falls in the late winter or early spring of 2025.

Tips for success

- Keep all of your paperwork: From your first sales conversation to years into the lifespan of your solar panels, it is always best to keep all of your system’s information somewhere safe and easy to access. When it comes time to file Form 5695 for your solar tax credit, you won’t want to be scrambling for information.

- Don't put it off: If you fail to file your taxes on time, you may be at risk of losing eligibility for the residential clean energy credit. Even though it rolls over if filed on time, you cannot claim the RCEC the year after your system was installed.

- Work with a professional: With anything tax-related, it is always advised to seek professional assistance at every stage of the process. Just as Palmetto has solar experts ready to help you save on energy bills, tax professionals will ensure Form 5695 is filled out correctly and at the maximum value for your investment.

Claim Your Solar Tax Credit With Form 5695

The solar tax credit makes investing in solar panels a wise financial investment for your home. Earning the Residential Clean Energy Credit includes the following steps:

- You must be eligible for residential energy credits.

- Form 5695 must be filled out correctly.

- You must include Form 5695 when you file your returns.

Palmetto is a clean energy company that believes solar power can change our world for the better, but we are not tax preparation experts. We recommend you seek out the advice of a licensed accountant or tax professional if you have any specific questions about filling out Form 5695 to claim the Residential Clean Energy Credit.

Palmetto is committed to providing green solutions for a clean and renewable energy future, including solar power systems, battery storage, and our Palmetto Protect monitoring service. Contact us to learn more about how we can help you maximize your solar experience.

Residential Clean Energy Credit 2024 FAQ

What is the maximum solar tax credit amount?

When claiming the federal 30% credit for a solar electric system, there is no financial limit on the potential value of your tax credit. With that said, there are many limitations that will cap the total price of your solar energy system, including capacity limits, property challenges, and budget constraints.

What happens if my tax liability is smaller than the credit amount?

If your federal income liability is smaller than your solar tax credit, fear not, as the solar tax credit can “roll over” year after year until you’ve used the full credit. For example, let’s say you have a $4,000 tax liability and a $6,000 tax credit. In this instance, you could put the excess $2,000 credit towards your federal income liability the following calendar year.

Discover what happens if your tax liability is too small.

How does solar depreciation affect your taxes?

If you are a homeowner with solar panels, the depreciation of your system should garner no tax implications. Instead, solar panel depreciation deductions are generally only available for business owners or clean energy systems on commercial properties.

Can you claim solar tax credit online?

Yes, Form 5695 for the solar tax credit can usually be claimed online, alongside the rest of your tax filing. Whether you utilize consumer software, file independently, or work with a tax professional, Form 5695 can be found online, filled out, and attached to your records using a number of resources from the IRS and private businesses.

See what solar can do for you:

Disclaimer: This content is for educational purposes only. Palmetto does not provide tax, legal, or accounting advice. Please consult your own tax, legal, and accounting advisors.

Andrew GiermakWriter and Editor

Andrew GiermakWriter and EditorAndrew joined Palmetto in Charlotte in August 2024. He’s been a writer in journalism, then in business, going back to almost the 20th century. He’s lived in Indiana, Virginia, Pennsylvania, Virginia again, and now North Carolina for the last 12 years. He likes golf. Is he good at it? Not so much.